Investment action

I recommended a buy rating for Waste Connections (TSX:WCN:CA) stock when I wrote about it the last time, as I expected the company to adeptly execute its strategic plans, particularly in enhancing margins by letting go of low-margin contracts and enforcing price increases more aggressively than its competitor. Based on my current outlook and analysis of WCH, I reiterate my buy rating for WCN. The company’s performance in the third quarter of 2023 underscores its sustained momentum and robust growth. Additionally, the management’s guidance is promising, forecasting double-digit growth for FY23 and continued expansion into 2024, further bolstered by anticipated margin expansion.

Review

In the third quarter of 2023, WCN witnessed several positive trends that underscored their robust performance. The company reported revenue of $2.06 billion. This figure represents an increase of 9.8% compared to the revenue for the same quarter in the previous year. One of the standout metrics was the growth in landfill gas sales, which saw an increase of 7% year-over-year. This uptick was primarily attributed to the rise in renewable energy credits. Another area that showcased growth was E&P waste revenue. The company reported that this revenue stream reached $59 million in the third quarter, marking 6% sequential growth from the second quarter and a commendable 10% growth on a year-over-year basis.

In addition to the company’s robust revenue growth reported in the third quarter, its adjusted EBITDA increased by 14.1% compared to the previous year, reaching a total of $671 million. This figure not only surpassed the company’s own guidance but also showed a strong margin performance. The adjusted EBITDA margin stood at 32.5%, which was an increase of 1.4% sequentially from the second quarter. On a year-over-year comparison, this margin was up by 1.2%.

In the third quarter, WCN observed a notable uptick in their special waste activity. This increase came after two consecutive quarters where the special waste activity had been on the decline. The resurgence in the third quarter was attributed to certain jobs that either got postponed from the second quarter or were likely advanced from the fourth quarter. This shift underscores the event-driven nature of these projects and highlights the inherent unpredictability or lumpiness associated with them. To provide a clearer picture, the special waste tons saw a significant rise of 17% year-over-year in the third quarter. When analyzed over a nine-month period, the special waste tons exhibited a growth of 1% year-over-year. The data suggests that while there might be short-term fluctuations, the overall trend for special waste activity remains positive. The ability of WCN to adapt to these shifts and capitalize on opportunities in the special waste segment showcases the company’s agility and robust operational strategy.

Following WCN’s impressive results, management has conveyed a positive forecast for 2024. Their achievements in 2023 reflect their adeptness in operations. A significant aspect of their strategy has been prioritizing employee retention, which inherently boosts operational effectiveness and client relations. While comprehensive projections for 2024 are expected to be release in February, preliminary insights from the company are encouraging. Assuming a stable economic environment, WCN is anticipating for a high single-digit growth in adjusted EBITDA for 2024. Additionally, they also project a mid- to high-single-digit growth in revenue, driven by growth in solid waste management and acquisitions made in 2023.

Valuation

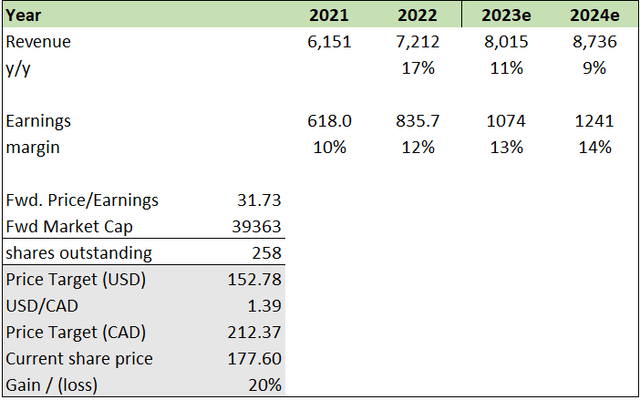

I believe WCN will grow at 11% and 9% for 2023 and 2024, respectively. This optimism stems from a combination of management’s guidance and prevailing market projections. In their recent earnings call, the management forecasted a fourth quarter revenue of $2.4 billion, leading me to project an approximate 11% revenue growth for 2023. For 2024, the guidance points towards mid- to high-single-digit revenue growth. This projection aligns well with WCN’s recent performance, which was marked by a notable revenue surge, partly attributed to the growth in landfill gas sales, buoyed by renewable energy credits. The E&P waste revenue segment’s growth further solidifies this outlook. The company’s adjusted EBITDA, surpassing expectations, is a testament to its financial strength. Moreover, the recent uptick in special waste activity after a short-lived decline emphasizes the company’s agility and adeptness in managing event-driven projects. All these factors collectively highlight a positive outlook for WCN.

Author’s work

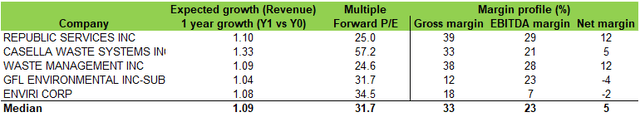

Currently, WCN trades at an approximate forward P/E of 28x, while its peers have a median P/E of 31.7x. Notably, WCN outperforms its peers in several financial metrics. Its 40% gross margin surpasses the peer median of 33%. Similarly, with an EBITDA margin of 31%, it stands well above the peer median of 23%. Furthermore, WCN boasts a net margin of 12%, more than double the peer median of 5%. Considering its expected growth rate for the next 12 months is 11%, compared to the 9% of its peers, I believe WCN should at least align with the peers’ median P/E. By adopting this conservative P/E approach, my target price indicates a potential upside of 20%. Given these factors, I continue to maintain a buy rating for WCN.

Author’s work

Risk and final thoughts

One downside risk to my buy rating is related to safety incidents. WCN encountered unexpected costs due to safety incidents. These incidents were linked to a higher rate of employee turnover in recent times. When there’s frequent staff changeover, it can sometimes result in more accidents or issues, particularly if newer employees aren’t as well-versed in safety procedures. Such safety-related challenges led to unanticipated expenses, which could affect margins. In addition, it causes reputation damage for the company.

WCN has showcased a strong performance in the third quarter of 2023. Key highlights include a surge in landfill gas sales, attributed to rising renewable energy credits, and impressive growth in the E&P waste revenue segment. Their financial health is further emphasized by the robust adjusted EBITDA, which not only exceeded the company’s expectations but also demonstrated commendable margin performance. Additionally, the company adeptly navigated the challenges in the special waste segment, reflecting their operational agility. WCN’s commitment to enhancing employee retention, pivotal for operational efficiency, further solidifies their position. Their forward-looking statements indicate a promising trajectory, with plans for significant growth bolstered by organic strategies and strategic acquisitions. Furthermore, when compared to its peers, WCN’s financial metrics are superior, suggesting its current forward P/E is too low. Given these factors, I maintain my buy rating for WCN.

Read the full article here