Investment thesis

Our current investment thesis is:

- WMK is a solid, low-risk business. Management appears to take a long-term view of the company, with a keen focus on operational and financial efficiency. For its size, WMK’s growth has been strong and its margins are respectable. Both of which are broadly achievable in the years to come. We see very little in the way of risks to its business model, owing to brand development, store modernizations, and its broader value proposition to customers.

Company description

Weis Markets (NYSE:WMK) is a well-established grocery retail chain, operating primarily in the Mid-Atlantic region of the United States. With a history dating back to 1912, Weis Markets has become a trusted name in the grocery industry, known for its commitment to quality, affordability, and community engagement.

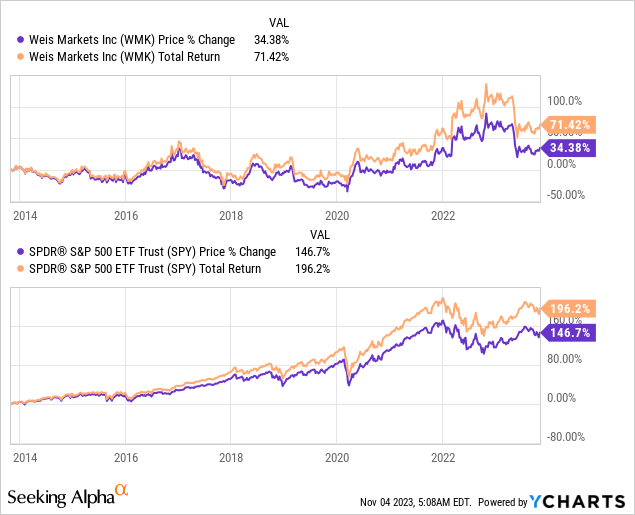

Share price

WMK’s share price performance has been mild during the last decade, with a return of ~60% inclusive of distributions. By comparison, the S&P has exceeded this noticeably at >150%. This is a reflection of mild financial development and a reasonable valuation.

Financial analysis

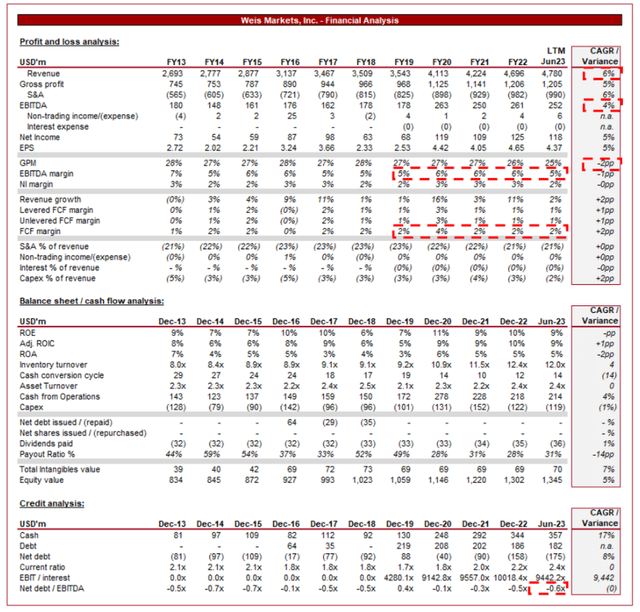

Weis Markets financials (Capital IQ)

Presented above are WMK’s financial results.

Revenue & commercial factors

WMK’s revenue has grown at a CAGR of +6% during the last decade, an impressive achievement for what is a highly mature, commoditized industry. Further, EBITDA has broadly tracked this, with growth of +4%.

Business model

WMK offers a diverse range of products, including fresh produce, meats, dairy, bakery items, and general merchandise. This variety allows the business to maximize its ability to satisfy household needs, making WMK a one-stop shopping destination.

WMK focuses heavily on a customer-centric approach, seeking to add value beyond just quality products, with investment in the customer service skills of its employees and the creation of a pleasant shopping experience. Given the company competes with significantly larger peers in some locations, this is absolutely critical.

WMK has a robust private label program, offering a variety of products under their own brand. We consider this a very important component of its business model. Private labels often yield higher profit margins and improves customer loyalty through trust in the value proposition of products. Further, this illustrates that the business has created a valuable brand.

Growth has been achieved through these factors, alongside a focus on enhancing its geographical location. This has been achieved through new store growth (11 in the last 5 years), as well as additions and major remodels (50 in the last 5 years).

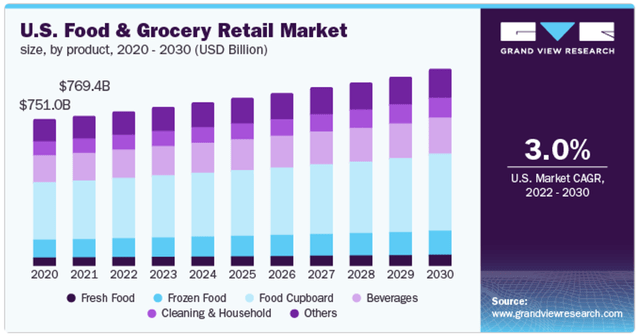

US food and grocery industry

The US food and groceries industry is forecast to grow at a CAGR of 3% in the coming 7 years, with a combination of low price increases and population growth.

Industry growth (GVR)

The grocery industry is highly competitive, with both large national chains and local stores vying for market share. The industry shows many of the qualities of saturation. This competition will likely limit WMK’s ability to significantly expand its customer base and exceed this 3% level. Key competitors include Walmart (WMT), Giant Food Stores, and Kroger (KR), among the many other regional and national players. ****

WMK’s regional focus, while providing a stable customer base, might limit its ability to tap into rapidly growing markets in other regions, where the large players will rapidly enter and gain market share. This said, the company can continue to target locations where the large players cannot justify entry, allowing for reduced competition.

Key growth drivers beyond inflation and population expansion will come from:

- Supply Chain Optimization – Efficient supply chain management and the ability to expand its product offering has the potential to improve its value proposition and win new customers.

- E-Commerce Expansion – The growing trend of online grocery shopping, driven by convenience and technological advancements, has the potential to outperform the traditional segment.

- Private Label Expansion – Growing the range of private label products it stocks will contribute to margin improvement.

- Consolidation – Scope for consolidation in underserved locations across the US is high. This could mean WMK goes on the offensive to acquire regional chains or the business is acquired.

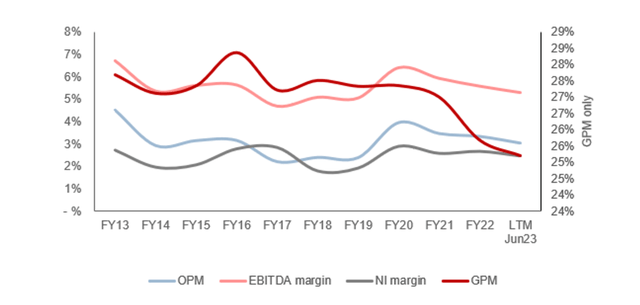

Margins

Margins (Capital IQ)

WMK’s margins have broadly been flat during the historical period, reflecting its strong established position and the maturity of the industry. Our view is that the ability to generate significant improvements, even through scale, is limited by the nature of the industry. This said, the company has seen a slide in the LTM period, heavily attributable to inflationary pressures impacting both operating costs and GP.

We suspect improvement in the medium-term is possible as pressures unwind, however, we are uncertain as to whether WMK can return to its pre-pandemic GPM. Although EBITDA-M/NIM is still at the FY19 level, the worsening unit economics leaves the business more susceptible to future pressures and contributing to potential underfunding of OpEx.

Quarterly results

WMK’s recent performance continues to be strong, with top-line revenue growth of +8.2%, +18.0%, +3.7%, and +3.8% during the last four quarters. In conjunction with this, margins appear to have stabilized, with three of the last four quarters having an EBITDA-M in excess of 5.2%.

The strength of its performance is a reflection of the company’s industry, with robust demand and the ability to increase prices sequentially despite the macroeconomic environment. Consumers are unlikely to stop grocery shopping (inelastic demand), although the risk is certainly that they trade down or downsize purchases. Therefore, there remains heightened risks but we believe WMK has navigated this well, illustrating a strong value proposition.

Looking ahead, we expect the environment to remain difficult, positioning WMK to continue its moderate growth and likely outperformance on an earnings basis relative to the wider market.

Balance sheet & cash flows

A key strength of WMK, and why its strategy is considered safe, is the lack of debt and FCF conversion. WMK is currently in a net cash position, with ~21% of its MC in cash. This has allowed the business to retain the majority of its profitability, which is critical in an industry with slim margins.

Inventory turnover has sequentially improved during the historical period, allowing FCF to be incredibly consistent, although insufficient to improve it. We limited risks associated with maintaining this existing level given the strong working capital management.

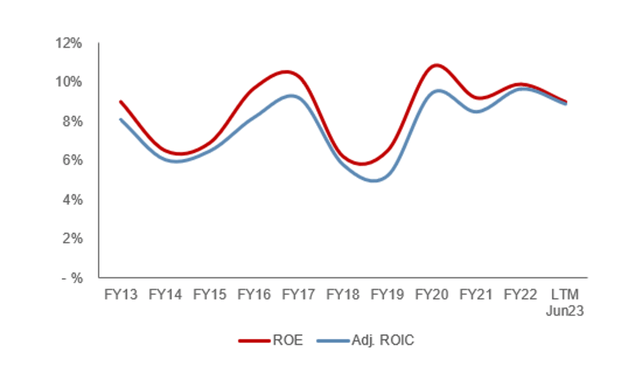

This operational excellence and broader strategy has allowed WMK to generate incredibly consistent returns, with an ROE of ~9% during the LTM period. We consider the range 8-11% to be maintainable going forward.

Return on equity (Capital IQ)

Industry analysis

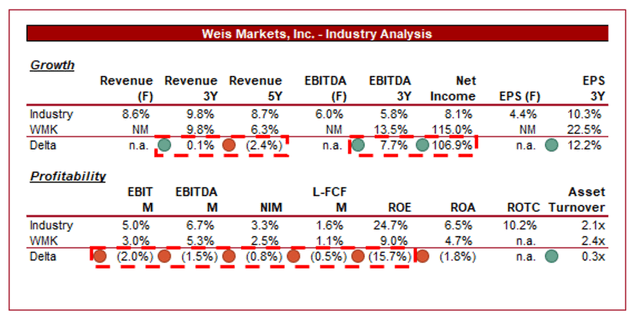

Hypermarkets and Super Centers Stocks (Seeking Alpha)

Presented above is a comparison of WMK’s growth and profitability to the average of the Hypermarket industry, as defined by Seeking Alpha (10 companies).

WMK performs respectably, although is clearly lacking. The company’s growth has been strong, producing comparable results to its peers, with outperformance coming in the way of profitability growth. We attribute this to greater unit economics in more profitable segments of the business, with WMK operating many services beyond just the traditional supermarket (Weis 2 Go, Weis Great Meals Start Here, Weis Gas-n-Go, and Weis Nutri-Facts).

This said, WMK continues to lag behind the industry in profitability, although has closed the gap on a LFCF basis. We attribute this to the company’s lack of scale on a relative basis, which is a gap the company is unlikely to close. Further, the ROE weakness is attributable to the lack of share buybacks, which WMK has the potential to do but its conservative approach implies it is unlikely.

Valuation

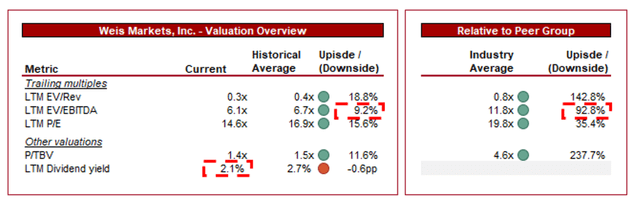

Valuation (Capital IQ)

WMK is currently trading at 6x LTM EBITDA and 15x LTM P/E, which represents a dividend yield of 2.1%. This is a premium/discount to its historical average.

A discount to its historical average appears unwarranted in our view. The company has maintained its existing trajectory for the entirety of the period, with a conservative strategy of incremental growth. We see no reason to imply a worsening of its competitive positioning. A very small discount could be attribute to lower store-growth potential, but even this we struggle to argue. This implies upside of ~9% on an EBITDA basis and ~16% on a PE basis.

Naturally, the company is trading at a steep discount to its peer group, which adequately reflects the lower profitability and reduced growth potential long term.

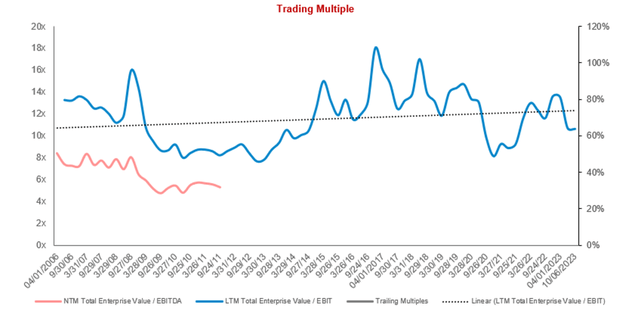

As a counterpoint, the following suggests WMK’s valuation has creeped up during the historical period, with a recent dip below the average. We believe this could be a reflection of markets pricing in reduced price-related revenue growth as further hikes will be difficult to justify, contributing to a slowdown in trajectory. This would not be unexpected given the market outlook has turned negative again.

Valuation evolution (Capital IQ)

Management

WMK’s Chairman, President, and CEO is Mr. Jonathan Weis, who is also a significant shareholder. Family run businesses generally outperform, owing to the perfect alignment of incentives. There are risks associated with Governance. This is compounded by the lack of analyst coverage, which means Management is not being held to account by a 3rd party. This makes us hesitant.

Key risks with our thesis

The risks to our current thesis are:

- Lack of analyst coverage – Lacking external oversight to assess Management’s strategy and the company’s direction.

- Family ownership (Governance) – Significant family influence and control over the business that cannot be easily challenged.

- Successful implementation of digital initiatives – Digital is a key risk to the business. Successful implementation could contribute to an improvement in growth.

Final thoughts

WMK is a solid company. It has achieved very respectable growth and margins during the last decade, with a comparable performance to its significantly larger peers. We attribute this to Management’s conservative approach to operating the business, with a focus on sustainable growth and limited debt utilization.

We believe the business represents an attractive investment for those seeking a low-risk business that has the potential to grow in the LSD into the long term. We do think there is capital upside at the current valuation but this appears partially offset by the risk of a top-line slowdown as inflationary price increases slow down.

At its current valuation, we do not see sufficient upside to suggest a buy.

Read the full article here