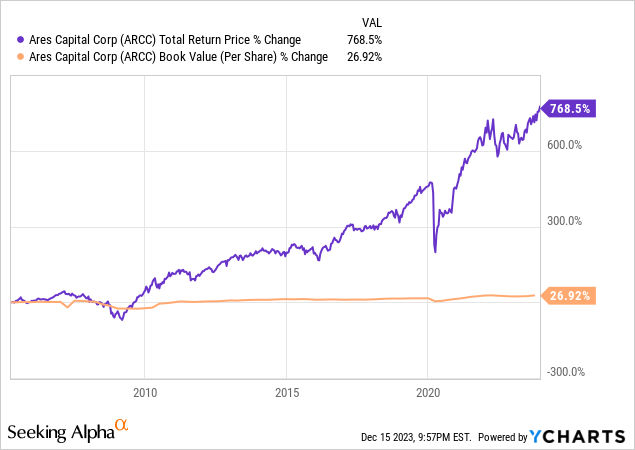

Ares Capital Corp (NASDAQ:ARCC) used to be my favorite overall Business Development Company (i.e., “BDC”) due to its phenomenal long-term track record of generating outsized total returns as well as sustaining and even growing NAV per share while also paying out a hefty dividend:

Much of this phenomenal performance is due to the expert management provided to the fund by Ares Management Corporation (ARES). That being said, I recently parted ways with my ARCC shares, and in this article, I will detail three reasons why.

#1. Recession and Rate Cuts on the Horizon

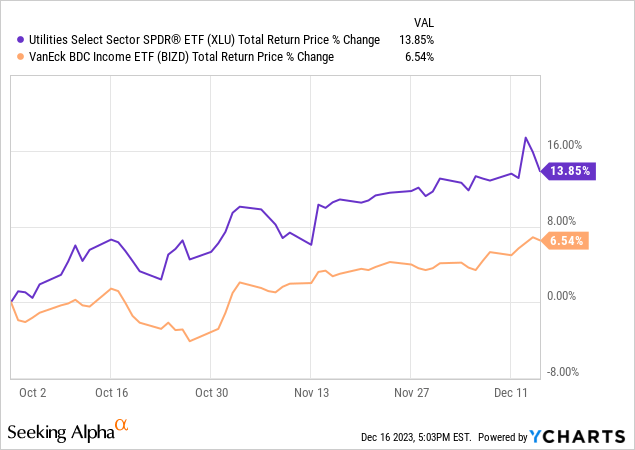

I recently sold several of my BDCs (BIZD) in addition to ARCC given my conviction that the forward macroeconomic outlook was unfavorable for them.

Predictions of a mild U.S. recession by Deutsche Bank and expectations of interest rate cuts as forecasted by Morningstar, UBS, and TD Securities suggest a challenging environment for BDCs such as ARCC with their relatively high leverage ratio and substantial exposure (ARCC has 84.2% exposure) to floating-rate middle market loans. The substantial anticipated rate cuts next year would likely lead to a decrease in ARCC’s net investment income as the interest income from its floating-rate loans falls.

Moreover, BDCs are often hit hard during recessions due to their exposure to middle-market companies, which are more vulnerable to economic downturns. ARCC’s leverage ratio of 50.25% means that any increase in defaults or non-accruals could significantly impact its bottom line and NAV.

As a result of my macroeconomic outlook, I recycled most of the capital into deeply undervalued utilities (XLU) that had been beaten down by aggressive interest rate hikes but appeared poised to benefit from rate cuts in 2024 and would likely withstand a recession well. Over the past few months, that decision has paid off handsomely, and I expect this trend to continue for the foreseeable future:

#2. ARCC Stock’s Valuation Has Gotten A Bit Rich

Another reason I sold my shares is because – as a value investor – valuation means a lot to me, and ARCC’s valuation is not particularly compelling at the moment. I base this conclusion on three major factors:

- ARCC’s price-to-book value ratio is currently 1.03x, which is in line with its five-year average and above its 10-year and all-time averages of 1.00x. While ARCC’s valuation here is not particularly high, it is not on sale and appears slightly overvalued, especially considering my second reason…

- As we pointed out earlier in this article, the macroeconomic conditions will likely shift from extremely positive for ARCC to much more negative. As a result, we think that ARCC should be trading at a discount to its historical average right now, rather than at a slight premium.

- As the table below illustrates, ARCC’s expense ratio is one of the highest in the BDC sector, further making the case against its worthiness of selling at a premium to NAV:

| Company Name (Ticker Symbol) | Expense Ratio (%) |

|---|---|

| Main Street Capital Corporation (MAIN) | 7.38 |

| Capital Southwest Corporation (CSWC) | 9.99 |

| Hercules Capital (HTGC) | 10.47 |

| Blackstone Secured Lending Fund (BXSL) | 11.25 |

| Goldman Sachs BDC (GSBD) | 12.15 |

| Golub Capital BDC (GBDC) | 12.74 |

| FS KKR Capital Corp (FSK) | 13.22 |

| Owl Rock Capital Corporation (OBDC) | 14.07 |

| Prospect Capital Corporation (PSEC) | 14.24 |

| Ares Capital Corporation | 14.37 |

| Oaktree Specialty Lending Corporation (OCSL) | 15.14 |

| Sixth Street Specialty Lending (TSLX) | 18.23 |

Table 1: BDCs Sorted by Expense Ratio (from Lowest to Highest) Based on Data from The BDC Universe

#3. ARCC Stock’s Portfolio Is Not Particularly Defensive

Last but not least, I sold my ARCC shares because – in addition to its significant exposure to floating rate middle market company-backed loans – ARCC’s portfolio also has one of the least defensive structures relative to its peers on a % loan and % senior secured loan basis:

| Ticker | % Portfolio Debt |

| GSBD | 99.10% |

| BXSL | 97.80% |

| GBDC | 96.90% |

| HTGC | 95.70% |

| TSLX | 95.10% |

| OCSL | 92.10% |

| CSWC | 91.40% |

| OBDC | 87.90% |

| BCSF | 84.20% |

| MAIN | 82.50% |

| BBDC | 81.70% |

| ARCC | 80.90% |

| NMFC | 80.50% |

| FSK | 79.60% |

| PSEC | 74.30% |

Table 2: BDCs Sorted by % Debt Exposure (from Highest to Lowest) Based on Data from The BDC Universe

| Ticker | % 1st / 2nd Lien |

| GSBD | 97.50% |

| BXSL | 97.30% |

| HTGC | 93.40% |

| TSLX | 93.30% |

| GBDC | 93.20% |

| CSWC | 87.10% |

| OCSL | 83.00% |

| OBDC | 82.60% |

| FSK | 75.50% |

| PSEC | 73.70% |

| BBDC | 73.50% |

| NMFC | 71.40% |

| MAIN | 68.80% |

| BCSF | 65.80% |

| ARCC | 64.90% |

Table 3: BDCs Sorted by % 1st/2nd Lien Exposure (from Highest to Lowest) Based on Data from The BDC Universe

This means that – in the event of a recession and non-accruals and defaults increase – ARCC is set up to suffer greater income and NAV per share losses than many of its more defensively positioned peers who have greater debt and senior-secured debt exposure than ARCC does.

Investor Takeaway

While ARCC has a very impressive track record, the current macroeconomic outlook makes its current valuation appear unattractive relative to its history and its portfolio positioning appear unattractive relative to its peers.

While we do think that its management’s proven skill at creating value over the long-term for shareholders earns it some slack – thereby justifying it trading in line with NAV despite having one of the highest expense ratios in the sector – we cannot justify paying a premium at this point in the economic cycle given the relatively weak positioning of its portfolio right now. As a result, we sold our shares and reallocated the proceeds into more defensive opportunities that are poised to benefit from interest rates declining in 2024.

Read the full article here