The game that Mr. Market continuously plays with investors is fascinating.

Exactly 24 years ago, on March 27, 2000, Cisco Systems, Inc. (CSCO) surpassed Microsoft Corporation’s (MSFT) $540 bln market cap and became the most valuable company on the planet.

This news sucked the last retail investors in the dot-com rally.

Cisco maintained this number one position for exactly one day, and March 27, 2000, entered the history books as the peak of the dot-com bubble.

Afterwards, Cisco crashed by -90% from March 2000 to October 2002.

History never repeats itself, but it often times rhymes.

Today, I am seeing a very similar scenario playing out with Nvidia Corporation (NASDAQ:NVDA), the leading AI infrastructure provider.

Nvidia ($2,300 bln market cap) looks on its way to surpass Microsoft ($3,100 bln market cap) as the most valuable company later this year.

And just like two decades ago, that may last for only a very short time and could not end well. Let me explain you why I believe so.

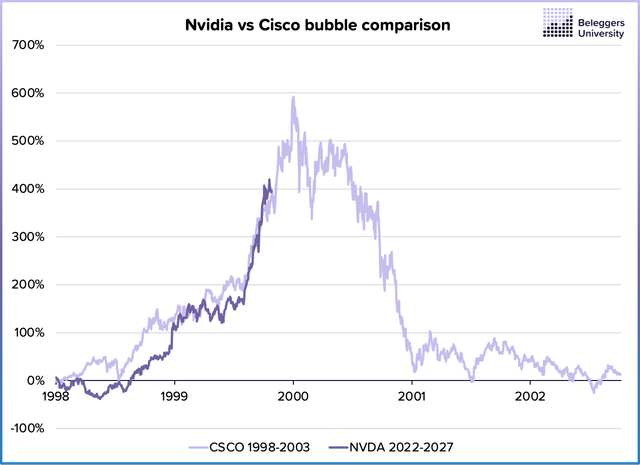

Nvidia vs. Cisco comparison: the first phase of a new tech revolution

Nvidia stock gained approximately +400% since June 2022 due to AI excitement.

Do I believe artificial intelligence (“AI”) will become one of the biggest technological revolutions in mankind? Yes, I have seen the incredible GTC event.

Do I believe AI is still in its early innings? Absolutely.

But does that mean guaranteed returns for Nvidia shareholders going forward? Less likely.

We have seen this happen before.

The deployment of the Internet has had an enormous impact on our economy, too. And it was still in its first phase in 2000.

Nonetheless, leader Cisco Systems collapsed after its boom and has returned -38% over the past 24 years.

(And that’s not cherry-picking. Other Internet infrastructure plays like Juniper Networks (JNPR) and Ciena Corp (CIEN) performed even worse.)

Nvidia 2024 vs Cisco 2000 chart comparison (Beleggers University)

So why did this horror happen with Cisco and what can we learn from it for Nvidia?

In contrast to the popular believe, it was not caused by extreme valuations.

Yes, Cisco was highly valued at its peak at 37 times sales and more than 200 times earnings.

But so were Amazon (AMZN) and Microsoft at 50 times and 26 times sales. Nonetheless, they gained by respectively +6,600% and +700% from the bubble peak to today.

Why did Amazon and Microsoft perform well from their high valuations and Cisco did not?

Well, they were situated in a different wave of the tech revolution.

- Wave one: companies build out their infrastructure, which is when the big hardware players temporarily benefit from increased demand. (Cisco)

- Wave two: companies roll out the technology to customers, which is when they benefit from continuous sales (Amazon and Microsoft)

In the late Nineties, companies went full gas on buying switchers, routers, and other Internet hardware.

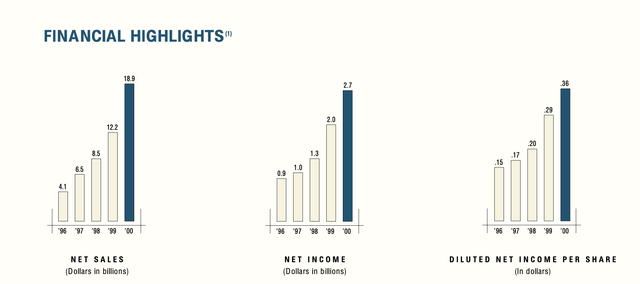

Cisco 5x’d its sales from 1996 to 2000 and made billions of profits off it.

Financials of Cisco from 1996 to 2000 (Cisco annual report)

Investors pumped money into Cisco Systems, which was the best-performing company at that time.

However, they forgot one important thing in their investment analysis – assessing the sustainability of this growth rate.

They believed the numbers would keep skyrocketing. That’s not possible if customers reduce or even entirely stop ordering after they fully built out their infrastructure need for the coming decade.

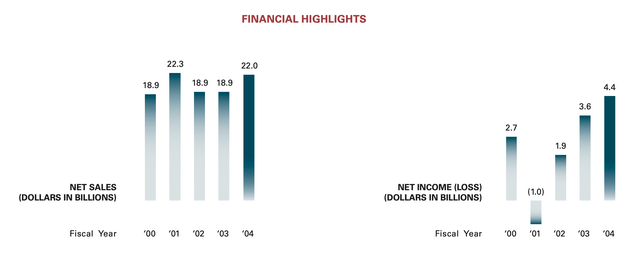

Here is how that translated in Cisco’s numbers in the years after the dot-com peak.

Financials of Cisco from 2000 to 2004 (Cisco annual report)

Is Cisco a bad company? Not really.

Was it a bad investment at the peak of its earnings cycle, because its earnings growth was not sustainable due to its cyclical nature? Definitely.

Similar to Cisco, Nvidia is situated in the first wave of the technological revolution, as a leading AI infrastructure hardware company.

And its cyclical nature will likely lead to even bigger problems than what happened to Cisco…

The big problem for Nvidia (shareholders)

Nvidia GPUs are all that big tech leaders are currently dreaming of. They want to build out their AI infrastructure as quick as possible to be at the forefront of the second wave of this technological revolution.

This video of Mark Zuckerberg (CEO of Meta Platforms (META)), in which he is bragging with his 350,000 Nvidia GPUs, is very telling.

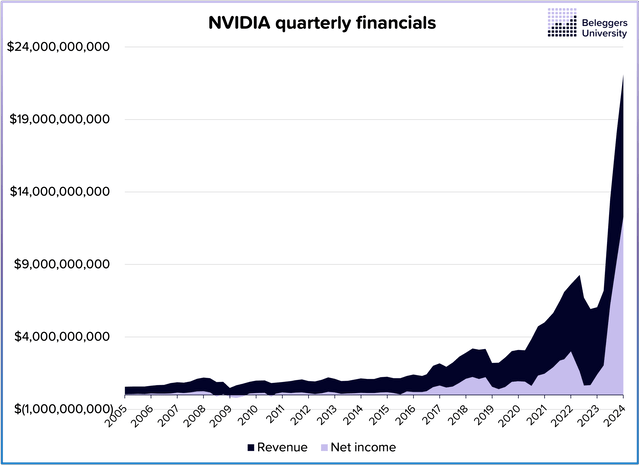

Nvidia’s sales and profits are skyrocketing. Not only because of higher volumes, but also because of aggressive price hikes as greedy customers pay whatever is necessary to build their AI infrastructure.

As such, last quarter revenues increased by +265% year-over-year and net profit margins expanded to 55.6%, much higher than the 25% 5-year average.

Quarterly profits have grown from $3 bln at its 2022 peak to $12 bln in the last earnings report.

NVIDIA’s cyclical sales and profits since 2005 (Beleggers University)

Once again, investors and analysts are cheering the current dominance of Nvidia, without questioning the sustainability of growth rates in the future:

- What will happen if customers notice that they overinvested and have all the AI capacity they need for years to come?

- What will happen if Nvidia loses its virtual monopoly and competitions kick in from the likes of Advanced Micro Devices (AMD) and Chinese competitors?

- What will happen if big customers succeed in building their own AI chips?

- What will happen if the China tensions worsen and Taiwan Semiconductor Manufacturing Company Limited (TSM) is not able to supply the chips for Nvidia anymore?

Let me tell you what will happen if one of these things occur…

Analyst forecasts will not be met. Sales will not grow steadily from $61 bln to $157 bln by FY2027, and net profit margins will definitely not stay at 52%.

Here is a more realistic idea: After another double in FY2025, sales might stagnate and profit margins could halve to their long-term average of 25%.

In contrast to Cisco, which did not suffer from margin contraction as its net profit margins stood at 15%, Nvidia could be hit by a double whammy.

| FY2024 | FY2027 analyst forecast | FY2027 realistic idea | |

| Sales | $60.9 bln | $157 bln | $120 bln |

| Net margin | 48.9% | 52.1% | 25% |

| Net profit | $29.8 bln | $81.9 bln | $30 bln |

At the moment that everything is going perfect, I know it is hard to imagine things getting worse.

But as an investor, you have to look forward and not get caught in today’s numbers.

Is Nvidia’s valuation super cheap at a 39x fwd P/E ratio?

Nvidia generated $30 bln ($12/share) in net profits for fiscal year 2024 and is expected to double that to $58 bln ($23/share) this year.

With the stock currently trading at approx. $900, that puts its current P/E ratio at 75 and forward P/E ratio at 39.

For such a strongly growing company, that is not expensive at all.

Even more, the forward PEG ratio stands at 0.43 (39/91.4), which is lower than 1 and thus can be called cheap.

Nvidia is not a bubble at all, it is actually one of the most attractively valued stocks on the market.

The real bubbles in my view are Advanced Micro Devices, Costco (COST) and Eli Lilly (LLY), all trading at far higher valuations than Nvidia.

| Forward P/E | Forward EPS growth rate | Forward PEG ratio | |

| Nvidia | 39 | +91.4% | 0.43 |

| AMD | 49 | +37.4% | 1.32 |

| Costco | 44 | +12.4% | 3.55 |

| Eli Lilly | 62 | +97.3% | 0.64 |

This is the reasoning that I have seen numerous times over the past weeks.

And just like most conventional wisdoms, I believe it is very faulty.

Investors should not blindly look at the price/earnings ratio, as it assumes current profits are sustainable.

Instead, investors should be worried about the price/earnings POWER ratio.

What will the earnings, and thus the valuation, look like in a normal environment?

Costco (groceries) and Eli Lilly (obesity drugs) are steadily growing businesses with recurring sales. Their profits will continue expanding each year.

AMD is cyclical, but its earnings have yet to benefit from the AI investment cycle.

These three stocks trade at a higher absolute P/E ratio, but their real price/earnings power ratio is probably a lot lower than Nvidia.

If my previous assumptions become reality, Nvidia’s P/E ratio would be at 75x by FY2027. That is today’s price/earnings power I am talking about. And it is very different to the 27x that analysts are projecting.

| FY2024 | FY2027 analyst forecast | FY2027 realistic idea | |

| Sales | $60.9 bln | $157 bln | $120 bln |

| Net margin | 48.9% | 52.1% | 25% |

| Net profit | $29.8 bln | $81.9 bln | $30 bln |

| EPS | $11.93 | $33.3 | $12 |

| P/E | 75x | 27x | 75x <– price/earnings power |

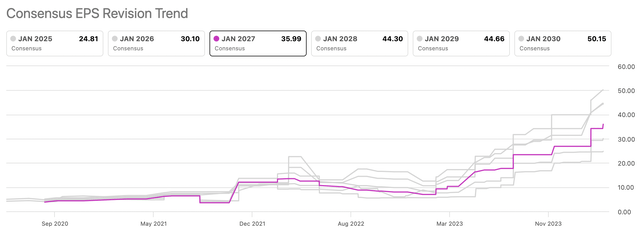

Don’t forget that one year ago, analysts projected $7 in EPS for 2027.

As much as they completely underestimated the upside potential of AI, they are now potentially overestimating it by projecting $33 in EPS for 2027.

Analyst NVIDIA EPS revisions over time (Seeking Alpha)

Is Nvidia stock in a bubble?

Over the past five years, Nvidia stock generated a staggering return of +1.880% (18x).

That’s a lot.

NVIDIA 5-year stock price (Seeking Alpha)

Of course, one cannot just look at a chart and say it is a bubble because the price has been going up.

It is only a bubble if prices get bid up without fundamental reasoning, but in the hope that some other fool will pay more for it in the near future.

And based on recent analyst recommendations, I believe Nvidia is getting there.

Cantor Fitzgerald and Wedbush have recently raised their target from $900 to $1,200 (+33% increase) and $850 to $1,000 (+18% increase) respectively.

The reason? They anticipated that the GTC Event would be a near term catalyst as it would give more insights into Nvidia’s AI offerings.

A scary reasoning behind multi-hundred-billion-dollar market cap target increases.

Another reason for me to believe that Nvidia might be in a bubble, is investors’ ignorance to actually read the financials.

Everyone seems to be calling out Nvidia’s impressive +265% YoY growth rate of last quarter.

However, as I pointed out on X, nobody seems to care that the numbers are rapidly deteriorating on a quarterly basis.

Revenue growth is trending down to +8.6% QoQ based on Q1 FY2025 guidance. If that trend continues, it is only a matter of time until investors get scared by stagnating revenue growth headlines.

Now the good news.

While I do believe that Nvidia stock might be turning into a bubble, I also agree that today’s stock market is not (yet) resembling the dot-com bubble.

We are lucky that we just witnessed a bubble in 2021, which I wrote extensively about. We are still recovering from that collapse and are nowhere near the frothiness we witnessed back then with IPOs and non-profitable growth.

As such, fortunately the risks are rather concentrated to AI and are limited for the overall market.

How I expect this to play out

At some point, I expect that investors will realize that Nvidia’s earnings power is much lower than the earnings it is producing in this overinvestment cycle.

When reality kicks in that Nvidia is still a cyclical company, I expect valuations to contract severely.

However, predicting when this cycle will end, is extremely hard (if not impossible) to do.

At times like these, it can be very interesting to look at historical comparisons.

Mr. Market loves to play games.

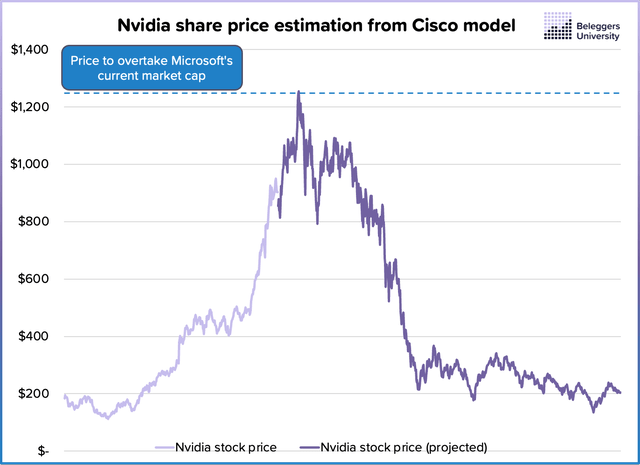

I would not be amazed if Nvidia’s bubble would inflate further, until it reaches the number one market cap position, just like Cisco did in 2000.

Nvidia needs another +40% gain to $1,265 per share to surpass Microsoft’s current valuation of $3.15 trillion.

If we use the Cisco model from before, that could look something like the chart below.

After after a slow-down in March and early April, Nvidia would gain +40% in the next three months to reach a final blow-off top. That would be followed by little weakness first and a huge selloff by late 2024/early 2025.

Beleggers University

Of course, I do not have a crystal ball and this is just a guesstimate. Nonetheless, my previous historical comparisons have proven to be very accurate, and I believe this one will have a high chance of resembling too.

So with this scenario in mind, how do I want to play this as an investor?

First things first, let’s respect Warren Buffett’s first and second rule of investing. – Don’t lose money.

The time to invest in Nvidia is during a cyclical downcycle, which I recommended to do in September 2022.

Don’t be one of the last retail investors getting sucked into this upcycle, believing things will go perfectly forever.

For the more advanced investors, how can we profit from the downside?

Again, don’t lose money. A lot of shorts have been burned shorting on the way up. Never (fully) short a bubble on its way up.

If Nvidia reaches the number one position, a very small speculative short option position might be warranted.

But the best risk/reward moment to short this, would be after the recovery from its first wave down, like September 2000 with Cisco.

From that moment, Nvidia could see more than -50% downside and weaker companies like Super Micro Computer (SMCI) might falter by more than -90%.

Conclusion

Nothing’s perfect, however, and everything eventually turns out to have flaws. When you pay for perfection, you don’t get what you expected, as the high price you pay exposes you to risk of loss when reality comes to light. This is truly one of the riskiest things. – Howard Marks, legend in stock market psychology.

Recently, I have heard that many retail investors are buying into Nvidia stock.

It hope that with this article I have given them more perspective on the risks regarding this investment.

Today, it looks like Nvidia is unstoppable due to the huge potential of AI.

However, everything turns out to have flaws.

If any flaw comes to light, Nvidia Corporation stock will have a very, very tough time as today’s valuation is extrapolating perfection into the future.

Just like with Cisco Systems, I fear that the last buyers of this boom will face significant downside and zero returns for decades to come.

I don’t want to spread fear with this article. All I want is to spread some sense of reality in an environment that I believe is become exogenously greedy.

Best of luck to all of you

Read the full article here