As many investors already know, there has been a notable repricing of REITs since the FED switched its stance on the monetary policy. Higher interest rates in general impose a downward pressure on almost all asset classes, but especially on those, where the dynamics of future cash flows resemble fixed income instruments.

In other words, the greater the duration risk, the greater the consequences of higher interest rates.

An interesting illustration of this is the Austrian century or 100-year bond. It was issued back in early 2020 and currently trades ~64% below the par. The bond holders have experienced 64% loss of capital (or are currently under water at this amount) not because of Austrian government going belly up or any country-specific difficulties, but purely due to the negative effects stemming from higher interest rates.

While REITs, obviously, do not embody so huge exposure to duration factor, they still act as quasi fixed income instruments. REIT have higher exposure to duration risk than pure-play equities because:

- Leases are typically signed on long-term contracts, which provides income visibility.

- These leases are oftentimes fixed or linked to conservative CPI movements, which makes it difficult to increase “coupons”.

- Without additional equity issuance, there are limited growth prospects.

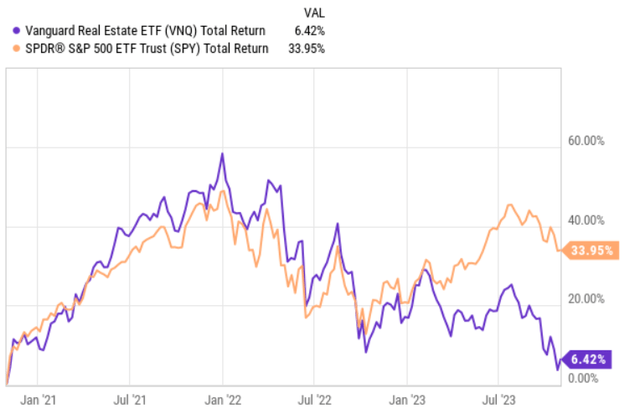

Ycharts

In the chart above, we can see how starting from early 2022 when the FED initiated a more aggressive policy the broader REIT market has declined in a similar manner as the S&P 500. Yet, at the same time, from February, 2023, REITs have significantly diverged from the market as the higher for longer scenario has assumed a more realistic probabilities.

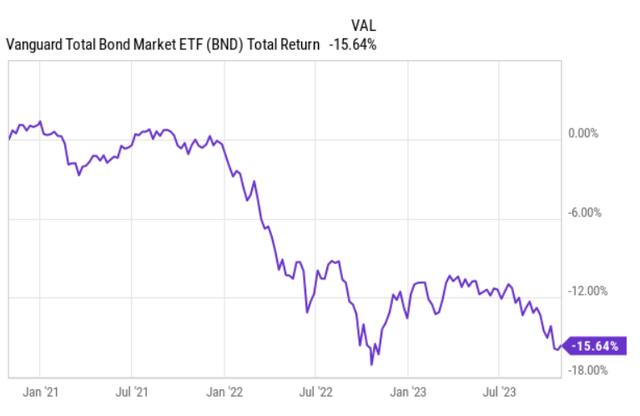

Ycharts

By looking at how the bond market has performed, we can observe rather similar patterns to the REIT space.

In essence, investors should not be surprised of the recent price declines across the board in REIT universe as it is only natural that higher interest rates impact higher duration assets more than, say, standard equities or short-dated fixed income instruments.

Nevertheless, there is one notable difference between REITs and safe fixed income securities in the context of recent price corrections. It is the exposure to business and financial risk that plays a more pronounced role in pricing / valuations relative to pure-play fixed income securities.

The challenge

The essence how REITs create value lies in the delta of the cost of capital and property cap rates. The wider the spread (cap rates exceeding cost of capital) the more value is created.

There are obviously quite many property-level activities that REITs can take after acquisitions to enhance the yield (e.g., rent indexation to CPI, redevelopments, better tenant mix etc.), but these are rather idiosyncratic and do not immediately move the needle.

The other element of the spread – cost of capital component – is what embodies a significant potential to impact the underlying cash flows and / or valuations.

Most REITs attract considerable portions of debt to bring down the weighted average cost of capital and enable large scale investments. When the cost of capital is below the property cap rates, a successful final investment decision can be made.

Now, because of the magnitude of leverage and historically narrow spreads due to ultra low interest rate era that we had before early 2022, even the slightest change in the financing costs could put REITs underwater (i.e., cost of capital exceeding cap rates).

For example, before COVID-19 a cap rate of 4-6% was quite typical for solid real estate located in primary markets. The cost of financing in these kind of transactions used to be cheap at around 2 – 3%, warranting a positive / acceptable spread. Then assuming additional basis points of yield enhancement via redevelopment or gradual lease increases deals looked even more attractive.

The problem now, however, is that the cost of capital (both equity and financing costs) has increased in a dramatic fashion, certainly exceeding the previously depressed cap rates at which the properties were acquired.

From a value creation standpoint it implies some clear headwinds to both the multiples and future cash flows. If the interest rates remain elevated, sooner or later the market level financing costs (which are much higher than historically acquired cap rates) will percolate through the books and consume an increased part of the current cash flows. This should coincide with the gradual refinancings of the fixed rate debt.

Optimal REIT investing strategy under higher for longer conditions

The risk of spread compression between property yields and cost of capital has already to some extent been reflected in the prevailing valuations. This is evident in the charts above.

Plus, we can confirm this by comparing small cap with large cap REITs (their share price performance).

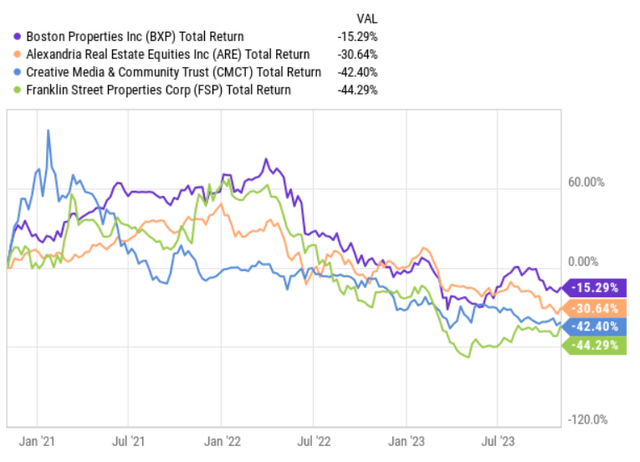

Below I have taken two largest REITs and compared their performance with two REITs, which have the tiniest market cap levels within specific REIT segment.

Selected office REITs:

Ycharts

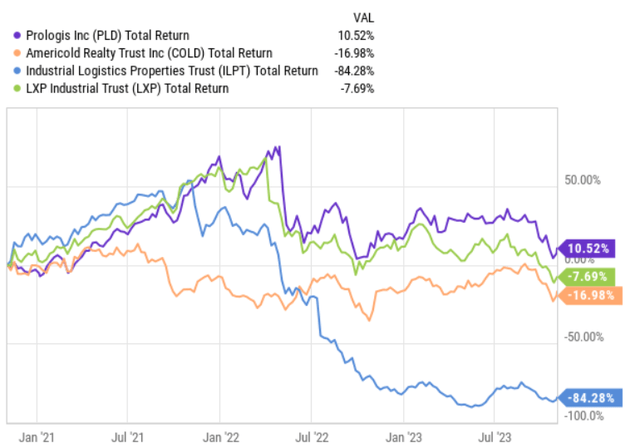

Selected industrial REITs:

Ycharts

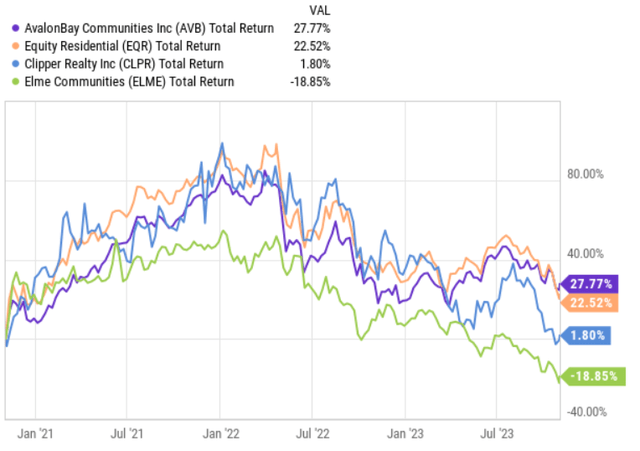

Selected apartment REITs:

Ycharts

We can see how larger cap REITs have clearly outperformed their smaller peers. Obviously, by going through the entire list we would notice some small cap REITs that have performed very strongly, but on average large caps have done much better since the Fed started to hike.

Now, one might ask whether there is still an opportunity left for investors to capture within the large cap REIT space.

The answer is that it depends on how the Fed Funds rate evolved from here.

In case the SOFR remains more or less constant on levels where it currently is, REITs (especially small caps) should experience further pain. By gradually unwinding the fixed interest rate debt positions and replacing them with freshly repriced debt, which reflects market interest rate levels, the FFO levels would be subject to a notable correction.

Granted, if the interest rates go down then it is highly likely that small cap REITs would bounce back in a more notable fashion than their more capitalized peers due to the currently depressed valuations. However, my conservative assumption is that interest rates will remain elevated and render unfavourable impact during the forthcoming refinancings in 2024 and 2025.

For REIT investors to protect their holdings and mitigate the risk of further downside corrections, when actual refinancing take place (the lion’s share of REITs have managed well their 2023 maturities) it would be critical to bias their portfolios towards large cap REITs.

The inherent advantage or value of large cap REITs in the context of restrictive interest rate environment lies their ability to keep the cost of capital as low as possible. This is also how the spread compression could be de-risked, thus strengthening the FFO prospects (relative to smaller players) after fixed rate debt positions are refinanced.

Below are the main avenues through which large cap REITs can keep the cost of capital as low as possible:

- Credit rating agency view – having an investment grade balance sheet is one of the key fundamentals to possess in order to combat the consequences of higher cost of capital. Here larger REITs have inherently stronger position to “negotiate” higher rating. More specifically, credit rating agencies take into account aspects such as size, business diversification and depth of financing sources to make their decisions. For small cap REITs the scoring on these factors are per definition less favourable imposing clear headwinds on the credit rating front.

- A pool of diversified financing sources – having the scale and size in the underlying operations (i.e., greater cash flows) requires larger ticket size financings, which become attractive to a broader base of institutional investors or lenders. In many instances for small cap REITs it is difficult to, say, issue small ticket size bond or structure a bank syndicate that would fall under the radar of many institutional managers as they oftentimes have minimum thresholds both on the issuer and issue level. Large cap REITs, instead, can structure a more sizeable issue, tap into financiers from different geographies (due to their material presence across states), and, in general, have greater bargaining power. In practice, it is also easier to negotiate favourable covenants, but that is not directly linked to the cost of capital component.

The bottom line

In my humble opinion, REIT investors should, to some extent, factor in a scenario in which the interest rates remain elevated for a higher period of time, thereby practically impacting the FFO generation levels after fixed rate debt refinancings that mostly start to kick in from 2024.

In that case when the FFO levels weaken due to higher interest costs stemming from painful debt rollovers, the chances are high that the market will further recalibrate REIT valuations to the downside. The spread between small cap and large cap REIT performance should further widen.

To mitigate this risk, where cost of capital that gets gradually reflected in the books destroy a notable part of the FFO, investors could consider introducing a more pronounced bias towards large cap players in their REIT portfolios.

My conservative belief is that the large cap REIT factor will continue to outperform small cap REIT factor throughout 2024.

Read the full article here