Not long ago, senior citizens got the two biggest annual increases in their monthly Social Security checks that most had ever seen. But for many of them, the adjustments still weren’t enough to cope with the runaway inflation of earlier this decade and the continued high prices for food, housing, utilities and other necessities.

That’s forcing more of them to spend their emergency savings, carry debt on credit cards or apply for assistance programs, according to The Senior Citizens League, a nonpartisan public education and advocacy group.

While inflation has afflicted Americans of every age, senior citizens are often in a more difficult predicament because many live off fixed incomes. Many depend heavily on Social Security – some 42% of elderly women and 37% of elderly men rely on the monthly payments for at least half their income, according to the Social Security Administration.

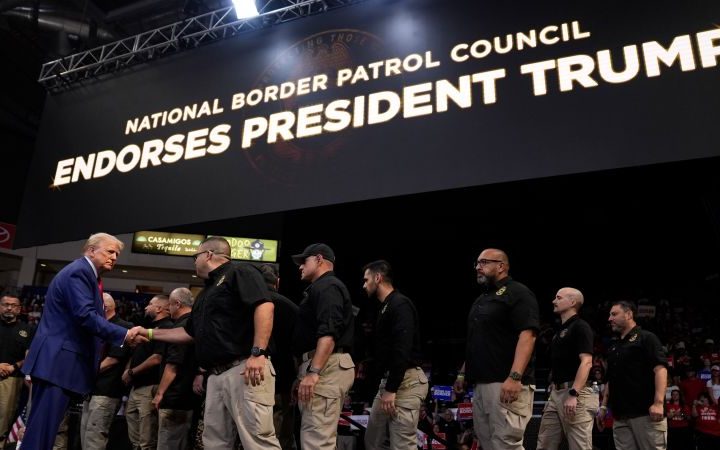

This squeeze could also politically influence some seniors, a key voting group, potentially weakening some of their support for President Joe Biden. Some polls have shown that Americans generally disapprove of Biden’s handling of the economy compared with former President Donald Trump, his presumptive rival in November’s election who enjoyed much tamer inflation during his administration.

Costs remain high

Senior citizens typically get an annual cost-of-living adjustment that’s based on inflation. But many of them and their advocates have long complained that the increases don’t keep up with their rising expenses.

They aren’t wrong: Inflation has eaten away at 36% of Social Security benefits’ buying power since 2000, according to an analysis last year from The Senior Citizens League. Those who retired before 2000 would need a nearly $517 boost in their monthly benefits just to maintain the same level of purchasing power as in 2000.

A spate of decades-high inflation, which peaked in mid-2022, led to annual cost-of-living adjustments of 5.9% for 2022 and 8.7% for 2023, the largest since the early 1980s. For this year, however, retirees are only receiving an increase of 3.2% because inflation has moderated.

At the same time, the league is hearing from many seniors that their household costs rose more than the benefit bump. Food is a particular pressure point – groceries are nearly 33% more expensive than they were in January 2021, when Biden took office, according to Datasembly’s Grocery Price Index.

This shortfall is forcing more seniors to turn to other sources of funds, such as savings or credit cards, and to assistance programs to help with rent, utilities, real estate taxes and health care costs, said Shannon Benton, the league’s executive director.

“They are suffering, literally suffering,” she said. “It’s worse now because of the unrelenting inflation of the past couple of years. It’s more profound in that it’s every item.”

More pain may be on the horizon. Inflation has been ticking up this year, with prices 3.5% higher in March than the year before. That means seniors are losing even more buying power since the rate exceeds their adjustment for this year, said Mary Johnson, an independent Social Security and Medicare policy analyst.

Next year’s bump may not offer much relief. Based on current projections, it would be 3%, Johnson said, though it could increase if prices continue rising. The adjustment is based on an inflation metric from August through October.

The timing may not be fortuitous for Biden since the annual adjustment is released in mid-October, just weeks before the election and as early voting is underway in some states.

Biden has been courting senior citizens – a large block of reliable voters – by emphasizing on the campaign trail his efforts to reduce prescription drug prices and repeating his vow to protect Social Security and Medicare, among other policies. A number of polls show older voters are closely split between Biden and Trump this year, with some giving Biden the edge. In 2020, Trump won their vote by 52% to 47%, according to exit polls.

The president needs these senior voters since polls also show his support among younger Americans has eroded since 2020. Also, at least four key swing states – Pennsylvania, Arizona, Michigan and Wisconsin – have a higher share of older residents than the nation as a whole.

While voters’ choices are often based on multiple factors, those who feel they’ve fallen behind financially tend to place more importance on the economy and inflation, said Marty Cohen, a professor of political science at James Madison University. That could limit Biden’s popularity among those people.

“To the degree that inflation may be hitting seniors harder, that has a potential to harm him among a group that he’s actually been doing better among than you might expect,” he said of Biden. “This is a race that will come down to tens of thousands of votes in six states or so. Everything is pivotal, everything counts.”

Read the full article here