Japan’s benchmark Nikkei 225 surpassed its all-time peak during intra-day trading on Thursday.

The index briefly hit 39,029 in afternoon trade, topping its previous record intraday level of 38,957.44 reached on December 29, 1989. It is also on track to smash its all-time closing high of 38,915.87, reached on the same day 34 years ago.

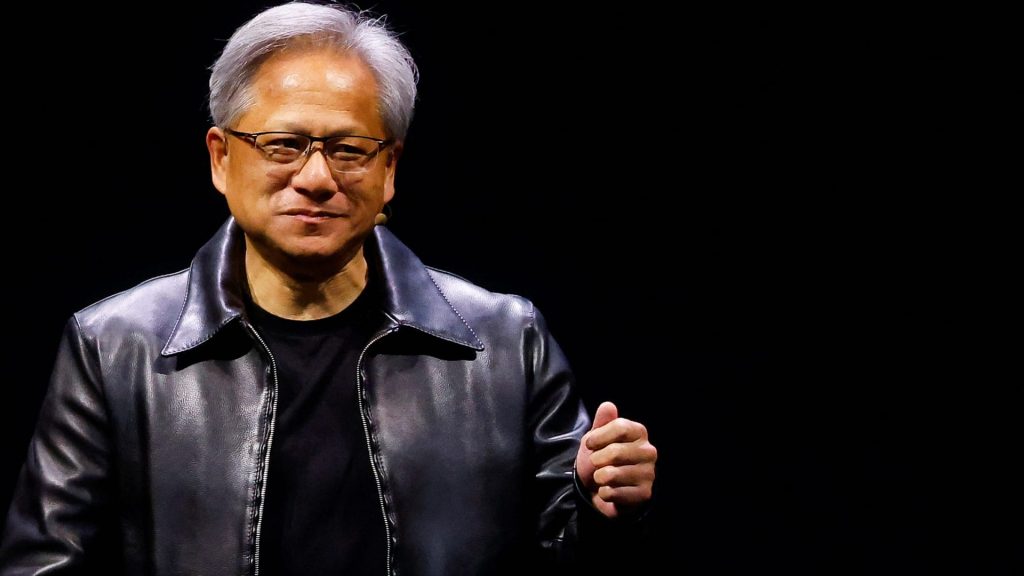

The rally was partly driven by a broad surge in chip stocks, after US chipmaker Nvidia (NVDA) posted strong earnings on Wednesday. Its quarterly profits were up 769% from a year ago. That drove a surge in Nvidia’s shares in aftermarket trading.

Semiconductor manufacturer Screen Holdings soared 9.8%. It was the top performer among Nikkei constituents. Advantest, which supplies testing equipment for the chip industry, surged 5.8%. Tokyo Electron, which sells electronics and semiconductor production equipment, advanced 4.6%.

Japan’s equities market had an exceptional year in 2023, with the Nikkei index up 28%, making it the best performing market in Asia. So far this year, the index has jumped 17%.

“Whilst this [rally] is partly supported by foreign inflows buying the larger names, it is primarily driven by fundamentals,” Daniel Hurley, a portfolio specialist for emerging market and Japanese equities at T. Rowe Price, said in a research note earlier this week.

A weak yen is among the primary factors driving the stock market up, Hurley said.

The yen has fallen more than 6% against the US dollar so far this year, after losing about 8% against the greenback in 2023. A weaker yen benefits Japanese exporters and makes shares in the nation’s companies cheaper for foreign investors.

Japanese technology companies also have a bright outlook, as demand for AI soars, Hurley added.

For the country to sustain this rally, Japan will have to deepen its “corporate governance reforms, which will further boost shareholder returns,” he said.

The Japanese government has implemented corporate governance reforms since 2013, with the aim of making businesses more accountable to their shareholders and promoting their sustainable growth.

This is a developing story and will be updated.

Read the full article here