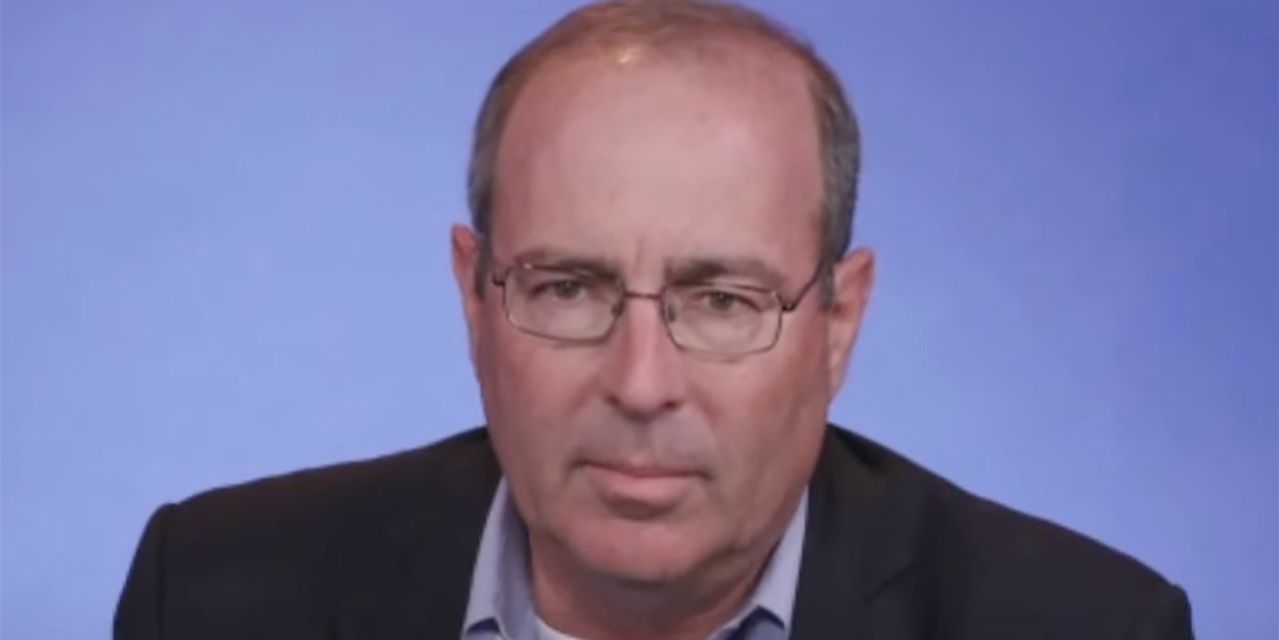

The U.S. economy may be softer than the data suggest and this weakness may be helping to moderate inflation pressure, said Richmond Fed President Tom Barkin said Tuesday.

“There’s a story — a plausible story — that weakening demand is already working to bring inflation down to 2%,” Barkin said in a speech to the Real Estate Roundtable in Washington DC.

While retail sales were strong in September and estimates of third quarter GDP are being revised higher, Barkin said that business contacts are telling him that demand “is softening.”

Lower-income consumers are “stretched thin” and middle-income consumers are trading down, he said.

At the same time, the labor market is “coming into better balance” and wage pressure has moderated.

“The question is how much of this softening is feeding through to inflation,” Barkin said,

Most, but not all, businesses think that the “period of major pricing power is behind them,” he said.

Barkin said the path for inflation “isn’t yet clear” and there is a wide range for potential outcomes for the economy,

The Fed “is walking a fine line” trying not to overcorrect and damage the economy or “undercorrect “and allow inflation to re-emerge.

In comments to reporters after his speech, Barkin said the September retail sales report, which showed two straight solid gains, was “strikingly strong.”

“The data is stronger than what I’m seeing,” he said, adding that he might have to rethink his outlook.

On the September inflation data, Barkin said the pickup in core was “a little higher than you would like.”

“You can’t take any one report too definitively. I think you have to accept the six reports before that report were strikingly good,” Barkin said.

Asked about the rise in the 10-year Treasury note yield

BX:TMUBMUSD10Y,

Barkin said the increase has tightened financial conditions but that long-term rates were not a policy variable because they can move so quickly.

Read the full article here