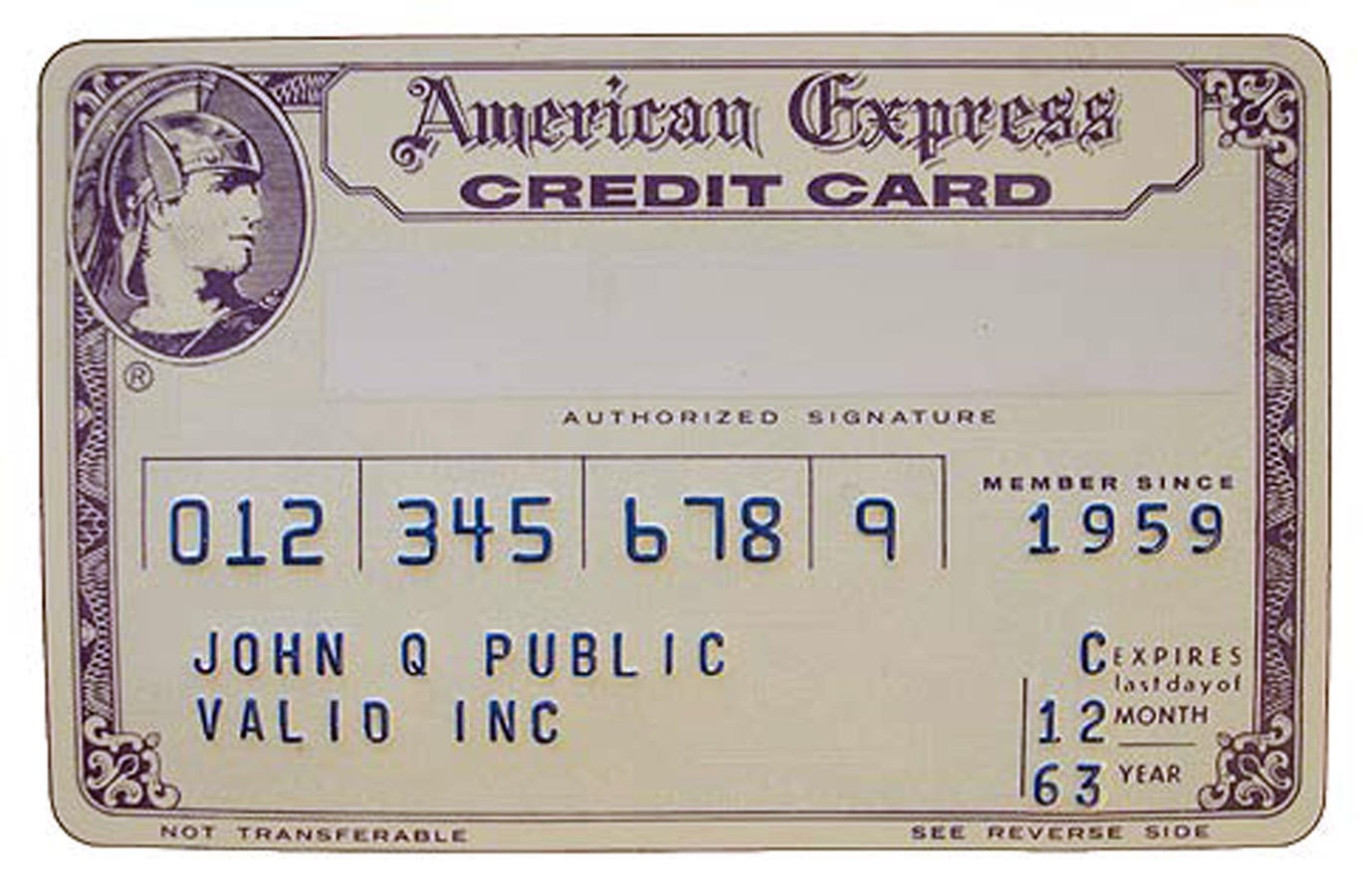

One thing we know about the future of fintech is the everything is going to be connected, even if intermittently. The Internet-of-Things (IoT) will be a platform for payments., for sure. Even cards. Here’s an example. American Express

AXP

Sailing Away

The Sailing Ship Effect refers to the impact of steamships in Victorian times. While in the long run, sailing ships were replaced by steamships, except for leisure, when the steamships first came on to the scene they led to a final burst of innovation from the sailing ship world, which was then stimulated into building some great ships (eg, the famous “Cutty Sark” that you can see in London). Perhaps we are now seeing this in the world of smart cards, as they enter their final age before being overtaken by smart phones, the cloud, blockchains or whatever.

The KB Kookmin Card is integrated into Samsung’s “SmartThings Find” platform so that cardholders can connect the card to their Galaxy smartphone to check its location via Bluetooth Low Energy (BLE) at home or abroad and be notified when its is a certain distance away. SmartThings Find uses Bluetooth Low Energy and ultra-wideband (BLE and UWB) technologies to help people find selected Galaxy smartphones, tablets, smartwatches and earbuds.

(You may not be familiar with UWB but it is at the heart of a battle for the micro location market. The new American Express card uses BLE only for the time being.)

Are clever smart cards with batteries and Bluetooth a trend? That’s not clear to me at all and the reason is, of course, that physical cards are on the way out. One of my issuers recently sent me a new premium card that is made out of some kind of metal (I’m pretty sure it’s not actual platinum, because platinum costs about £25 per gram and my card weighs 17g). The card is very nice and I am sure its metallic nature will impress my dinner guests when I clink it down on a restaurant table sometime.

Except, of course, that this will never happen.

It took me a few minutes to find the card so that I could weigh it for this article. It turned out to be in a bedside table (I’ve no idea why) and not the office drawer where I thought I’d left it. I use the platinum card product all the time, of course, but I use it on my phone. My wife has her favourite rewards card loaded into her keyring (well, actually, she has her Curve card loaded into her keyring, and it currently points to her favourite reward card). I have a prepaid debit card in the form of a ceramic ring that I use when in London for the day because I don’t want to take my phone out of my pocket when getting on the bus. And so it goes. Card products, but no cards.

The writing on the wall is, frankly, already pretty clear.

A recent survey by Forbes Advisor found that 53% of Americans already use digital wallets more often than traditional payment methods and 51% say they would stop shopping with a merchant that doesn’t accept payments from digital wallets. While as you might expect Generation Z are the most likely to adopt digital wallets as their primary payment method for shopping (91%), this is not a trend confined to the digital natives: Millennials and Gen Xers are also increasingly in favour of them, almost two-thirds of the respondents between the ages of 27 and 42 and half of the respondents between the ages of 43 and 58 using them more than traditional methods.

According to American Bankers’ 2023 “Future of Payments” report, one in ten boomers have used a digital wallet in-store compared to one in three millennials and “Gen Zs”. Boomers are twice as likely to use a credit card and three times as likely to use checks. Credit cards dominate in-store and online purchases for boomers (which makes sense, since 98% of boomer-owned cards have rewards) while GenZ prefers debit cards and only when transaction amounts rise do they move to credit cards and buy-now-pay-later (BNPL). In all cases, though, after prices the acceptance of the preferred payment choice is the next most important factor influencing the purchase choices.

Waving Goodbye

I’ll be sad to see cards disappear, of course. They were a big part of my professional life. I remember getting my first credit card (a Barclaycard) when I was at university and I remember getting an Amex gold card when I had been at work for a while. I remember the early experiments with smart cards (UKIS), the first chip and PIN cards (Amex Black), the transition to contactless interfaces (Mastercard

MA

V

Read the full article here